Alongside the rules introduced in October 2020 by Policy Statement (PS 20/6), the FCA published an accompanying guidance consultation (GC 20/1). That consultation has now resulted in the publication of finalised guidance (FG 21/3). The guidance, which takes effect from 30 March 2021, aims to help advisers understand the FCA’s expectations when advising on pension transfers and conversions. It arises out of supervision work undertaken pretty continuously by the FCA since 2015 which has consistently found that many firms are, “… struggling to give consistent, suitable advice. This is largely due to poor practices or weak record keeping. As a result, too much of the DB transfer advice we see is either unsuitable or we were unable to assess its suitability due to material information gaps (MIGs).”

The FCA expects firms to use the guidance to identify any weaknesses in their existing processes so they can put into place an appropriate framework for managing and delivering suitable advice on DB to defined contribution (DC) transfers.

Changes are likely to include the way in which firms:

- collect information about their client’s circumstances to give suitable advice

- use the information they collect to assess whether a DB transfer is suitable

- communicate their advice effectively to consumers

Key points

Over some 90 pages, the guidance covers the following five areas:

- Preparing to give defined benefit transfer advice

- Initial client interaction

- Advice process – information gathering and abridged advice

- Full advice process – research and analysis

- Suitability

Plus, a 7-page annex detailing the information that the FCA believes firms should obtain about the defined benefit scheme before providing advice. We look at that later in this article.

As the FCA is at pains to point out, the guidance is not a substitute for reading the relevant Handbook rules, but it is undoubtedly useful for all firms involved with transfer advice to ensure that relevant staff are made aware of the content of FG21/3. In the coming weeks, we will pick out some of the guidance and examine it in more detail. For the present, we will summarise some of the key points.

Good and poor practice

Dotted throughout the guidance are examples of what ‘Good practice’ and ‘Poor practice’ although we must say that some of these are well meaning but questionable in our view. Consider this example of good practice:

“A firm with the full permission sets out in its terms of business that it can give pension transfer advice and includes the charges for DB transfer advice in its charging structure. But it also sets out that ongoing advice services exclude advice on giving up any DB pensions that the client holds. The firm makes clear that during the yearly review, it will assume that the client continues to be a member of this type of scheme and will take the benefits at the normal retirement age. The firm explains that the complexity of DB transfer advice means that they would need to charge an additional fee for advising on whether to give up DB benefits each year. The firm only gives advice on a transfer or conversion if the client specifically asks for advice on whether to give up a specific DB pension.”

We can see what the FCA is getting at here and, in general, it could be good practice to avoid encouraging clients to consider transferring defined benefits and to make that position crystal clear to clients. However, as is often the case, there are exceptional circumstances where actively considering such action could be exactly the right thing to do – for example, a divorced client with adult children who is in serious ill health and with a significantly reduced life expectancy where the DB scheme would pay little or nothing out in the event of death but where transferred funds could be available to the children.

Similar criticism could be made of several other good practice examples, but it is important to remember that they are there to provoke some thought processes rather than be adopted wholesale by all firms.

Defined Benefit Advice Assessment Tool (DBAAT)

There is firm encouragement for firms to use the DBAAT, which sets out how the FCA reviews DB transfer advice. The tool sets out the key factors to consider when checking the suitability of advice and disclosure in transfer cases. We wrote about this in March, see here.

The current tool is based on pre-October 2020 rules and so is primarily intended for reviewing historical cases, but it is still largely relevant for current advice. A revised tool, taking account of the current rules is expected imminently.

The FCA is increasingly requiring the DBAAT to be used for formal past business reviews, including those conducted by external compliance consultants such as ATEB, so it would be prudent for firms to be familiar with its content and rationale.

Preparing to give defined benefit transfer advice

This section summarises the permissions regime – including when transfer permission is NOT needed, for example advising a client who is the beneficiary of a pension sharing order. And the pension transfer definition no longer includes transfers from non-safeguarded benefit schemes. So, firms no longer need the limited permission to advise on transfers from DC occupational pension schemes without safeguarded benefits.

But buying an annuity could be considered a transfer in some circumstances, so be wary.

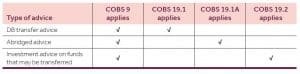

Suitability rules apply dependent upon the nature of the advice being given:

The section also discusses PII cover in some detail, including capital resources requirements for firms and the obligations of PII providers or distributors.

Other topics visited in this section include, conflicts of interest, CPD, financial promotions, use of introducers and, most important, systems and controls and record keeping/MI.

Initial client interaction

This section provides guidance around applying the charging rules and initial disclosure, including the ban on contingent charging. Triage also gets a mention, with a steer for firms how to avoid straying into regulated advice territory.

Advice process – information gathering and abridged advice

Three aspects are covered here. Gathering information is discussed in great detail. Firms are well advised to read this section carefully, especially the guidance around assessing the client’s attitude to transfer risk. In our experience, many firms do not do this well – some not discernably at all!

The abridged advice process is covered and guidance on identifying the ‘carve-outs’, i.e. those cases where the ban on contingent charging does not apply (serious ill health and serious financial hardship).

Full advice process – research and analysis

Researching and analysing the case are the stars of this section with a detailed look at the TVC and APTA with specific guidance around how various aspects should be considered, death benefits, desire for PCLS and so on. ‘Special’ situations are also examined, including self-investors, overseas transfers and the two-adviser model.

Suitability

The content of this section should come as no surprise – it is all about demonstrating suitability, factors to consider and creating a credible suitability report. However, we would draw attention to the first paragraph in this section.

“If you do not collect the necessary information including, for full DB transfer advice, the TVC and APTA, you must not make a personal recommendation. This is because you cannot be sure that your advice will be suitable. If you make a personal recommendation without this information, you will not comply with the suitability requirements. By not complying, there is a higher risk that your advice will be unsuitable.”

Read that carefully. It is clear to us from recent experience of dealing with firms where the FCA has reviewed transfer cases that the review can fail before it even gets as far as any consideration of the suitability of the transfer or investment advice (yes, these are considered as two related but distinct recommendations). That happens where the reviewer concludes that there are MIGs – material information gaps. The above statement refers to COBS 9.2.6 …

“If a firm does not obtain the necessary information to assess suitability, it must not make a personal recommendation to the client or take a decision to trade for him.”

This rule has been firmly in place since 2007 and frequently breached over the years, deliberately or otherwise. The FCA is increasingly using this rule in reviews of transfer advice and MIGs are considered a breach. If you don’t have enough information you cannot advise – period.

Scheme information

Clearly, having sufficient information about the defined benefit scheme is critical. To this end, the Financial Conduct Authority and The Pensions Regulator have collaborated with the Pensions Administration Standards Association (PASA) to agree a single set of information that defined benefit schemes should provide automatically with a transfer quotation.

Firms should collect this information before giving pension transfer advice. There is no prescribed format. The information can be provided in one document, or member information can be provided separately to scheme information, in any order or format.

The guidance includes a 7-page annex summarising the detail that should be provided automatically by the scheme. Schemes are also being encouraged to provide additional information that may help firms understand how the scheme rules work in practice.

Not all of the information will be relevant to every member, depending on their personal circumstances. Familiarity with the annex is essential to ensuring that sufficient scheme information has been gathered to provide a recommendation and avoid fall fouling of COBS 9.2.6.

![iStock-2156168033 [Converted] iStock-2156168033 [Converted]](https://news.ateb-group.co.uk/wp-content/uploads/2024/11/iStock-2156168033-Converted-1920x960-250x230.jpg)

Template Enhancements: Inheritance Tax (IHT) & Pensions

Doug McFarlane Suitability 2024, Budget, content management, IHT, Inheritance Tax, Pension, Pensions, PI, protection, Suitability Review, Template Enhancement, Update

To prepare for the introduction of Inheritance Tax (IHT) on pensions starting in April 2027, we have implemented the following template update: A new wizard question has been added to the ‘Current IHT Position’ table. This allows users to include pension assets in the estate value when calculating a client’s potential IHT liability. Please […]