You may well have seen reports that the FCA recently published its Defined Benefit Advice Assessment Tool (DBAAT). This is the tool that the FCA has been using as part of the ongoing review of firms providing transfer advice. At launch, the FCA stated:

“We published the DBAAT to help firms and pension transfer specialists understand the FCA’s file review methodology for DB transfer advice.”

As you would expect, we examined the tool with professional interest. We undertake a large number of pension transfer file checks for firms, either as part of a regular service or in relation to helping firms with feedback from the FCA ongoing review. Accordingly, we are very familiar with the FCA’s general approach to assessing the suitability of pension transfer advice, but we were nonetheless interested to understand the tool and glean whatever new insights it might provide. We were also keen to compare the results from using the DBAAT against the same case as reviewed under ATEB’s file check process and standards.

In the few weeks since the publication of the tool, it has become apparent that the FCA is increasingly asking firms to undertake past business reviews using the DBAAT. As we help many firms with past business reviews, that means that we have added incentive to understand and be able to use the DBAAT.

Having got to grips with it, we would definitely agree that firms and advisers involved in transfer advice would be well advised to do the same. Even though it is based on pre-October 2020 rules, all the content and logic remains valid for current transfer advice cases. The FCA is working on an updated version that will reflect post-October 2020 rules around abridged advice and contingent charging and this will be published in the coming months alongside finalised guidance (following on from GC 20/01).

Understanding the DBAAT

The DBAAT is accompanied by a series of 9 videos on how to use the tool. Each video lasts between 1.5 and 4 minutes so you can watch all 9 in less than half an hour. These were clearly designed for an internal FCA audience of reviewers who might well have, let’s say, a variety of prior knowledge of pension technicalities. The videos are of passing interest but there is no substitute for working through a case and referring to the 104 page guide when necessary. Links to the videos and other related items can be found here.

What did we find?

We reviewed the tool and overall considered it to be pretty sound. It is based on an Excel spreadsheet and does contain some ‘calculated’ scores. These are described as ‘suggestions’. Users have the option to disagree with the suggested score and assess the case using their own judgement and provide evidence to support that conclusion.

The headline good news is that we tested two cases using the ATEB process and the DBAAT process and the outcome was essentially the same, although the two systems use slightly different language.

The bad news is that the DBAAT process took substantially longer than our own process. This can probably be partly attributed to the fact that we were using the DBAAT for the first time whereas we are very familiar with the ATEB system. Practice makes perfect, so we would expect the time taken to reduce to some extent. However, the DBAAT does require much more basic personal and scheme data to be logged which is where the majority of time is taken up. The ATEB system takes account of all such information but does not require it all to be painstakingly entered.

The DBAAT tool’s greatest strength is its binary nature (although some holes in the ‘binary-ness’ do exist – see below) as this is bound to drive a degree of consistency between different reviewers, especially if those reviewers have little or no pension background beyond FCA internal training workshops. But that is also arguably its greatest weakness.

We found the tool contains a few flawed questions where a binary yes or no answer is required but where the correct answer, with a nod to Little Britain’s Vicky Pollard character, would be ‘yes, but …’ or ‘no, but …’. Examples include:

- ‘Has the firm obtained the necessary information regarding the client’s attitude to transfer risk?’

In practice, we find that many firms do not have a clear process to assess transfer risk. Usually, some aspects of transfer risk are clearly discussed with the client but, in the absence of clear guidance from the FCA about how this should be assessed and documented it is often difficult to see clear evidence of a transfer risk assessment or at least an adequate one, which satisfies the requirements!

For the record, the aspects that should be assessed against attitude to transfer risk are in COBS 19.1.6 as follows:

(i) the risks and benefits of staying in the ceding arrangement;

(ii) the risks and benefits of transferring into an arrangement with flexible benefits;

(iii) the retail client’s attitude to certainty of income in retirement;

(iv) whether the retail client would be likely to access funds in an arrangement with flexible benefits in an unplanned way;

(v) the likely impact of (iv) on the sustainability of the funds over time;

(vi) the retail client’s attitude to and experience of managing investments or paying for advice on investments so long as the funds last; and

(vii) the retail client’s attitude to any restrictions on their ability to access funds in the ceding arrangement

- ‘The client has incurred unnecessary or excessive adviser or product charges?’

As is the case for all questions, this one requires a binary yes or no response but depends upon a subjective judgement of what is unnecessary or excessive. - ‘The suitability report explains why the firm concluded that the recommended transaction is suitable for the client.’

Similarly, this question does not allow for any QUALITY assessment. It is entirely possible that the suitability report explains the rationale but for that explanation to be inadequate. - ‘Has the firm taken reasonable steps to ensure that the client understands how the key outcomes from the APTA and the TVC contribute towards the personal recommendation?’

Finally, this question repeats the binary yet subjective problem – what is reasonable?

This criticism might seem unfair but it is actually crucial. In most of the sections, a yes or a no to one question can change the ‘suggested’ conclusion for the whole section. This conclusion is calculated from the responses but it is not clear whether any weighting applies. In our experience, it is rare for any single factor to carry so much weight that it overrides everything else. The opportunity for the user to enter a different conclusion offers some counterbalance to the overall binary nature of the tool’s output but it is probably not easy for the FCA’s reviewers to fully override the ‘computer says no’ calculated conclusion.

Key points

The tool assesses suitability in two stages, the suitability of the transfer recommendation and the suitability of the investment recommendation.

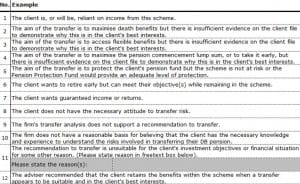

The tool includes a number of unsuitability examples. Firms should consider all transfer advice very carefully against these examples.

New Content Integration with Pacific Asset Management

Doug McFarlane Suitability 2025, Content Integration, content management, EU, FCA, Integration, Investment, ML, Pacific, Pacific Asset Management, PI, Update

We have some exciting news on the latest upgrade to ATEB Suitability on 9 April 2025. This update comes at no additional cost and provides a new addition to our content integration library. We have partnered with Pacific Asset Management to provide our customer firms with access to the following: A description of their service […]