This fourth in a series of articles on FG 21/3 takes a closer look at the guidance around pre-advice information for clients enquiring about pension transfer advice. The FCA calls this ‘triage’, which derives from the French word trier which means to sort or to select. This label is really a misnomer as pre-advice information is intended to enable the CLIENT to decide whether to engage with the advice process rather than the firm deciding whether to engage with the client.

You can read our previous articles on the topic here.

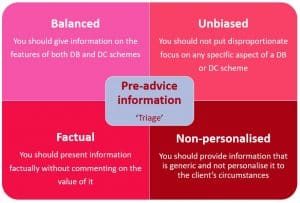

Pre-advice information must …

… present information factually, without making judgments, to ensure that ‘triage’ services do not stray across the regulated advice boundary. In particular, the information should be balanced, unbiased, factual and non-personalised.

Pre-advice information must not …

- give information on the sort of consumers who might benefit from a transfer, but not give information on the sort of consumers who might benefit from remaining in the DB scheme

- suggest that a death benefit payable as an income stream or as a lump sum is preferable

- exaggerate the risks of a scheme entering the Pension Protection Fund (PPF)

- present the reduction in benefits provided by the PPF as a worse outcome than a transfer

- underplay the benefits of DB pensions by failing to mention lifelong certainty of income, revaluation and indexation, or overplaying the benefits of DC pensions by over-emphasising flexibility and death benefits

- fail to mention the charges that would be incurred in a DC scheme and which would not be incurred in a DB scheme

- indicate that a consumer may be more or less likely to benefit from a pension transfer, based on their personal circumstances

- give an opinion on the likelihood of a transfer proceeding based on the absolute or relative value of the ceding scheme or proposed scheme benefits, including scheme multiples

- send a letter to an existing client who you think is unsuited to a transfer but has expressed an interest in one, setting out generic reasons why they should not transfer but not the generic reasons why they might consider a transfer

- provide modelling tools to scheme members of the scheme, showing illustrative values that compare the outcomes they might get if they keep a safeguarded benefit or transfer/convert it into flexible benefits.

New Content Integration with Pacific Asset Management

Doug McFarlane Suitability 2025, Content Integration, content management, EU, FCA, Integration, Investment, ML, Pacific, Pacific Asset Management, PI, Update

We have some exciting news on the latest upgrade to ATEB Suitability on 9 April 2025. This update comes at no additional cost and provides a new addition to our content integration library. We have partnered with Pacific Asset Management to provide our customer firms with access to the following: A description of their service […]